After a five-week stretch of declines, mortgage rates ticked up this week, sending ripples of dread through an already shaky spring market.

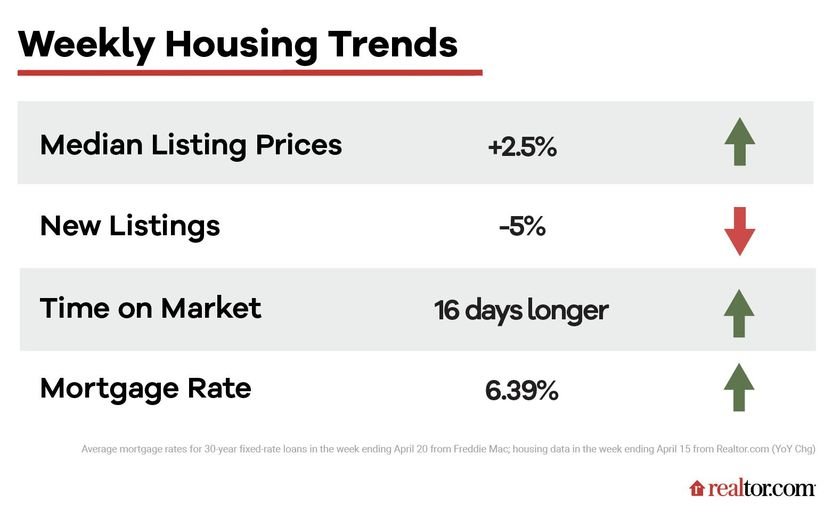

For the week ending April 20, rates for a 30-year fixed-rated loan averaged 6.39%, up from last week’s 6.27%, according to Freddie Mac.

For context, current mortgage rates are lower than the 6.48% that kicked off the year. But they’re still a whole lot higher than the 5.11% enjoyed by homebuyers this same week in 2022.

These ups and downs have put many homebuyers in a panic over whether it’s wise to buy now or wait. And that’s just one of many problems raising their blood pressure today.

To help both homebuyers and sellers stay one step ahead of today’s rapidly evolving spring housing market, we’ll break down the latest real estate statistics in this installment of “How’s the Housing Market This Week?”

Home prices are still inching up

In addition to contending with rising mortgage rates, homebuyers must also grapple with climbing home prices.

In March, homes were listed for a median price of $424,000. And for the week ending April 15, listing prices grew by 2.5% compared with a year earlier.

“Home prices are climbing as they typically do in the spring. However, momentum continues to dissipate,” Realtor.com Chief Economist Danielle Hale noted in her weekly analysis. In fact, this week’s growth is the slowest she’s seen since May 2020.

“Home prices are likely to go up from month to month through the summer, as they usually do,” she predicts. “But the jumps will be smaller than we saw in 2022.”

In other words, homebuyers will have to deal with slightly higher home prices, but nothing nearly as bad as the runaway sticker shock they experienced last summer. Nonetheless, when you combine these prices with today’s higher mortgage rates, the picture is still grim.

For homebuyers who put 20% down on a typical house, their mortgage payments will now amount to $600 or more per month than last year.

“Home prices have stabilized somewhat, but with supply tight and rates stuck above 6%, affordable housing continues to be a serious issue for many potential homebuyers,” Freddie Mac’s chief economist Sam Khater noted. “Unless rates drop into the mid-5% range, demand will only modestly recover.”

New listings are still down

Even though homebuyers are coughing up hundreds more per month for a house, the pickings are slimmer than ever.

Although housing inventory is 44% higher for the week ending April 15 than a year earlier, many of these listings are stale and have been stuck on the market 16 days longer than this same period last year. This means that homebuyers have likely seen and passed over a lot of these options already.

Meanwhile, fresh real estate listings just entering the market have been dwindling every week for the past 10 months, and continued downward by 5% for the week ending April 15.

The reason so many homeowners are reluctant to list right now is that many are also buyers who don’t want to trade in their current low-interest mortgage for today’s higher rates.

“Inventory is likely to continue to be a problem, with 82% of those looking to buy and sell feeling ‘locked in’ by their current low mortgage rate,” says Hale.

What’s more, she predicts that this sentiment is “unlikely to change much with current mortgage rates more than 2 percentage points above the rates a majority of homeowners currently have.”

How high rates are strangling the spring market

Ironically, these rising mortgage rates have hit right at what’s been deemed the best week to sell of the entire year. Realtor.com data shows that from April 16 to 22, homes typically earn $8,400 more than they would in a typical week.

Yet unless mortgage rates dip, it will be hard to persuade homeowners to list and make the most of this seasonal high point.

However, there is one group of homeowners who are somewhat immune to the vicissitudes of mortgage rates that gives economists hope of getting the spring market moving.

“Older seller-buyers, who are likely to have a smaller mortgage balance and greater equity, are less likely to report feeling locked in and also more likely to report that they need to sell anyway,” points out Hale. “This is likely to mean that older households will continue to play a prominent role on both sides of the home sale transaction in 2023.”

And let’s also remember the comforting words of Lawrence Yun, chief economist for the National Association of Realtors®: “Calmer inflation means lower mortgage rates, eventually. Mortgage rates slipping down to under 6% looks very likely toward the year’s end.”

Source: Realtor.com